Your Comprehensive Guide to U.S. Immigration for Greek and Cypriot Citizens

U.S. immigration can be complex, especially with all the visa options available. This guide aims to explain the process for citizens of Greece and Cyprus, covering various visa options. It will also explain work pathways, tax obligations, and crucial warnings about immigration fraud that Greek and Cypriots need to know.

Tourist Visas & the Visa Waiver Program: Understanding U.S. Entry

Many travelers from Greece and Cyprus usually want to know how long they can stay in the U.S. and whether they can legally extend their stay. The U.S. immigration law treats individuals who enter the country under the visa waiver program (i.e., without a visa, but only with electronic authorization via the internet) and those who enter with a B1/B2 tourist visa differently.

The Visa Waiver Program (VWP) and ESTA

The visa waiver program, which is often mistaken with ESTA, has several advantages and disadvantages for the traveler.

Pros:

- Low cost and convenience: The traveler can easily travel without needing to visit a U.S. consulate.

- Fixed Stay: Once entry into the U.S. is permitted, the traveler is allowed to stay up to 90 days. The border officer decides only whether to admit the traveler, but if admitted, the stay is always exactly 90 days. (There are two exceptions to this rule: if the traveler’s passport expires before 90 days, the border officer can allow stay only until the passport expires. Also, if the traveler was previously in the U.S. and left for a few days to Canada, Mexico, or Caribbean islands, then the traveler is entitled only to the remaining days left from the initial 90 days, not a full 90 days.)

Cons

- Strict 90-Day Limit: It is almost always impossible to extend the stay beyond 90 days.

- No Resetting the Clock: If a traveler overstays even by one day, they will never be able to travel again to the U.S. under the visa waiver—they will need a visa for every future U.S. trip (and there is no guarantee the visa application will be approved).

- Severe Overstay Penalties: If the overstay exceeds 180 days, the traveler will face a three-year entry ban from the date of departure.

- Bars to Re-Entry: If the overstay exceeds one year, the entry ban will be for ten full years. This ban applies even if the Greek or Cypriot traveler marries a U.S. citizen.

The B1/B2 Tourist Visa

Traveling with a B1/B2 tourist visa generally allows a stay of six months. While this is the main benefit, there are also several other advantages and drawbacks:

Pros:

- Longer Permitted Stay: Traveling with a B1/B2 tourist visa allows a stay of six months

- Possibility of Extension: The exact permitted length of stay depends on the border officer at entry—usually six months, but the officer has discretion to grant shorter or longer stays in some cases. Unlike the visa waiver, it is sometimes possible to extend your stay in the U.S. when you enter with a tourist visa.

- Multiple Entries: The visa validity period granted by the U.S. embassy is the time during which the visa holder can travel to the U.S., not the length of stay. For example, if you have a ten-year visa in your passport, you can travel to the U.S. for tourism anytime within those ten years, but each visit cannot exceed the time granted by the border officer when they stamp your passport or the white I-94 form completed on the plane.

Cons

- Automatic Visa Cancellation on Overstay: If a traveler overstays beyond the permitted time, the visa is automatically canceled and cannot be used for future travel.

- Bars to Re-Entry: As with the visa waiver, overstays beyond 180 days trigger a three-year ban, and overstays over one year trigger a ten-year ban.

Repeated Stays and Border Scrutiny

For Greek and Cypriot travelers who want to stay longer in the U.S., the tourist visa is preferable. However, the major challenge is the difficulty in getting a tourist visa. Unlike in the past, when the tourist visa was the only option for most, since the visa waiver only applied to certain countries, now citizens of various countries can travel visa-free under the visa waiver program.

As a result, the U.S. embassy is more suspicious when someone from a country under the VWP applies for a visa, and the likelihood of refusal is very high, especially if the applicant cannot justify why they need the visa (often wanting to stay over three months is incompatible with tourist status). Worse still, the ESTA authorization form asks if the traveler has previously applied for a visa that was denied. Thus, a traveler who wants to stay six months and applies for a visa risks doing more than damage, meaning applying for a visa and being denied, which can also lead to ESTA denial.

Voluntary Withdrawal of Application for Admission

A very common question among Greeks and Cypriots who wish to stay long in the U.S. is how soon they can return after a previous stay. While there is no exact rule, the longer the previous stay and the shorter the time outside the U.S., the more suspicious the border officer becomes.

Remember, the tourist visa is for tourism and related activities, not for permanent residence. So it is generally good practice for the traveler to stay outside the U.S. longer than they stayed inside after each trip. Multiple consecutive long stays increase the likelihood of being sent to “secondary inspection,” meaning a separate area at the airport for detailed questioning. This unpleasant process can result in the denial of entry for some travelers.

There is a significant legal distinction between those entering with the visa waiver and those with a visa: a visa holder denied entry is automatically barred for five years, even if married to a U.S. citizen. On the other hand, a traveler denied entry under the visa waiver is only barred from using the visa waiver program again, not general entry. In other words, the visa waiver is better for entry into the U.S., but once inside, a visa provides more rights and options.

(Note: In some cases, instead of denying entry, the border officer may allow the traveler to withdraw their application and voluntarily leave the country. This is particularly beneficial as it helps the traveler avoid adverse legal consequences related to denial of entry.)

Work Visas: Pathways and Challenges

The first step for Greeks and Cypriots who want to work in the U.S. is to have a job offer from an American employer in a field that requires a university degree. This means a professional job and not, for example, working in a relative’s restaurant. With a few exceptions for individuals with extraordinary and rare abilities (internationally recognized scientists, etc.—see below), a job offer is essential, since the entire legal process for working in the U.S. begins with the initiative of the American employer, not the foreign national.

The Essential Role of an American Employer

The main challenge professionals from Greece and Cyprus who want to work in the U.S. face is to find an American employer. However, there are several ways and approaches you can use to find an employer.

Common Pathways to Finding a Sponsoring Employer

- U.S. Education (F-1 Visa): The most common way to find a job in the U.S. is by starting with studies. Anyone studying at an American university can easily approach large American companies for job openings. Additionally, the student visa (F-1) allows you to work in the U.S. for twelve months after completing studies.

- Intra-Company Transfers (L-1 Visa): Transfers by a company you already work for and has offices in the U.S is also a common Greeks and Cypriots to find a sponsoring U.S. employer. The L-1 visa is designed for those who have worked for at least one year outside the U.S. and want to be transferred to the offices of the same company in the U.S. The L-1 transfer visa offers several advantages, including the ease of proceeding with an application for a green card, which grants the right to permanent residency in the U.S. indefinitely.

- Direct Job Applications (H-1B Visa): With some luck and very strong qualifications, Greeks and Cypriots can apply directly for jobs at American companies in the U.S. However, it is quite difficult for a U.S. company to express interest in someone located on the other side of the Atlantic. If you find an employer, the company can start the process for an H-1B visa. These visas are limited per year and become effective on October 1st of each year. This means that if the visas for the current year have been exhausted, you will need to wait until October 1st of the following year to begin working. The H-1B visa is for temporary work for a specific employer and does not provide the rights of a green card, which has much higher requirements. Employers usually test the employee first with a temporary visa before starting the green card process.

Exceptions: Direct Green Card Pathways Without a Job Offer

Certain special categories of individuals, including those with extraordinary abilities in science, arts, education, business, or athletics, or internationally recognized researchers, can apply for a green card directly without a job offer. Unlike citizens of countries like Canada and Australia, who can immigrate to the U.S. without a job offer (and without family ties to a U.S. citizen or permanent resident), Greeks and Cypriots must have exceptional qualifications in their field, and very few meet these very strict criteria. For more information, you should consult a Greek immigration lawyer who will carefully review your qualifications.

Key Takeaways for Aspiring U.S. Workers

If you want to find a job in the U.S., you must be patient and persistent. The most important thing is to acquire specialized qualifications that are in high demand, either through work experience or specialized studies. Technical fields like information technology and the sciences readily accept immigrants from Greece, Cyprus, and other countries. If you decide to travel to the U.S. under the visa waiver program to find work, you should know that even if you find an employer in the U.S., you must return to the American embassy and come back with a work visa before you begin working. It is also best to consult a Greek nationality attorney USA to guide you with the process and outline the key requirements.

D-1 Visa: Crewmember Visas

The D-1 visa is for seafarers and crew members who wish to enter the U.S. to perform their professional duties on ships, aircraft, or other vehicles engaged in international or commercial flights and voyages. The visa allows holders to enter the country for a limited period, provided they are crew members working on a transportation vehicle recognized by U.S. authorities.

Scope of Activities and Duration of Stay

Seafarers or crew traveling on a D-1 visa are not permitted to engage in other professional activities in the U.S. apart from their work on the ship or aircraft. The duration of stay is limited and depends on the length of the mission or voyage, generally not exceeding 29 days.

Holders of the D-1 visa can stay temporarily in the U.S. according to the legal procedures applicable to ship and aircraft crews. After their stay, they are required to depart and return to their work outside the U.S. or travel to other countries.

Family Members (D-2 Visa)

Since the D-1 visa does not allow holders to undertake any other form of employment in the U.S., their spouses and children can travel with them on a D-2 visa. This is a dependent visa for crew family members, but they are not permitted to work in the U.S. While the requirements of the visa are well stipulated, a Greek citizenship attorney can guide you in following the due process.

E-1 Visa: Treaty Traders

The E-1 visa allows citizens of the Treaty Countries listed here to travel to the U.S. for extended periods to work as treaty traders. The visa is specifically designed to facilitate trade between the United States and treaty countries.

E-1 Visa Eligibility Requirements

The conditions for issuing an E-1 visa are:

- The applicant must be a citizen of a treaty country

- The company for which the applicant will work in the U.S. must be at least 50% owned by a citizen of a treaty country. If the company is owned by a citizen of a treaty country with a green card or U.S. citizenship, they are not counted as citizens of their treaty country for proving ownership.

- The applicant’s trade in the U.S. must be substantial and continuous.

- The trade must be primarily between the U.S. and the treaty country, exceeding 50% of the total trade.

- Trade includes cross-border exchange/sale of goods, services, and technology.

- The applicant must hold a managerial position in the company or have specialized knowledge or skills essential for the company’s operation.

Application Process and Recommendations

The E-1 visa is a relatively easy and quick way for people to work in the U.S., provided the conditions are met. In most cases, it is recommended to use a specialized immigration lawyer to prepare all the required documents. For Greeks and Cypriots, finding reputable Greek citizenship lawyer online services will help you prepare all the required documents and navigate the complexities of the application.

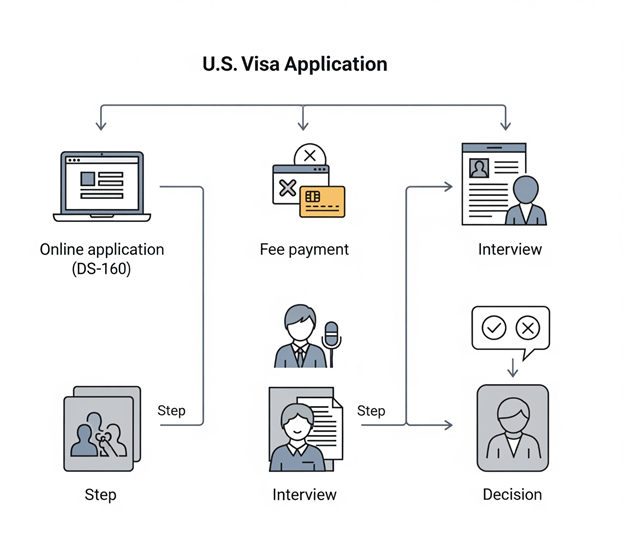

Alt Title: U.S. Visa Application Process Flowchart

Alt Description: A simplified infographic outlining the typical steps involved in applying for a U.S. visa, including online forms, interviews at the embassy, and decision notification, relevant for Greek and Cypriot applicants.

H1-B Work Visa: A Path to U.S. Employment

The non-immigrant H1-B work visa is one of the most common ways to work in the U.S. If you are a Greek or Cypriots, you must have a job offer from a U.S. employer, and the job generally requires a university degree (or, in some cases, other specialized skills) to qualify for this visa. The employer must then hire an immigration attorney to begin the visa application process. Legal fees for these cases usually run into several thousand dollars, and U.S. law requires the employer to cover these costs without charging the employee.

Annual Cap and Filing Season

U.S. law limits the number of H1-B visas to 65,000 per year, but there are usually more than 65,000 applicants. An additional 20,000 visas are also available for individuals with U.S. master’s degrees, with some jobs in non-profit organizations being exempt from the cap.) Applications are processed on a first-come, first-served basis. Those who wish to start work on October 1, when the U.S. government’s fiscal year begins, must have an employer who files the petition in time before visas run out.

The earliest an employer can file for an October 1 start is April 1 of the same year. After April, available visas quickly run out, often by July. This means that applicants may have to wait until the next April filing period to begin working the following October.

Visa Duration and Family Provisions

The H1-B visa can be renewed for up to six years and only permits employment with the specific employer who submitted the petition. The visa allows the spouse and children of the employee to reside in the U.S., but they are not authorized to work there.

H-2A, H-2B, and H-3 Visas: An Introduction

The H-2A, H-2B, and H-3 work visas are special categories that allow temporary employment in the U.S., covering different needs and sectors. Each visa type has distinct requirements and purposes, but all provide Greeks and Cypriots the opportunity to work in the U.S. for a limited period.

H-2A Visa: Agricultural Workers

The H-2A visa is designed for agricultural workers who require temporary employment in the U.S. It allows employers in the agricultural sector to hire Greek and Cypriot workers when no American workers are available to fill the need. The H-2A visa is limited to seasonal or temporary work and is valid for the duration necessary to complete agricultural activities. Employers must prove that the job cannot be filled by U.S. workers and must provide housing and meals for the Greek and Cypriot workers.

H-2B Visa: Non-Agricultural Temporary Workers

The H-2B visa covers other sectors that require seasonal or temporary workers, such as construction, tourism, or other services. Although not limited to agriculture like the H2-A, H-2B follows a similar approval process. However, the availability of this visa is limited and involves strict approval criteria. Employers must demonstrate that the work is temporary and that there is insufficient U.S. labor to meet their needs.

H-3 Visa: Trainees and Special Education Exchange Visitors

The H-3 visa is intended for individuals coming to the U.S. for educational or training programs that do not involve paid employment. Although not directly related to work activity, it allows Greeks and Cypriots to participate in specialized training programs that enhance their skills in their field without receiving direct compensation from their employer.

Key Characteristics of H Visas

All the H visas are temporary and do not lead directly to permanent residence in the U.S. However, they allow Greeks and Cypriots to work in the U.S. for a specified period, subject to appropriate applications and approval by the U.S. government.

Working with a good Greek citizenship lawyer USA can help you determine the best options. For instance, direct conversion to a Green Card isn’t possible. However, an H-2 visa holder can pursue a Green Card if a U.S. employer is willing to sponsor them for a permanent position, typically through an employment-based visa that requires a permanent job offer and labor certification.

O-1 Visa: Extraordinary Ability and Achievement

The O-1 visa is a unique ways Greece and Cyprus citizens with special achievement can stay in the United States. The visa is particularly meant for individuals with extraordinary ability or achievements in the fields of science, arts, business, education, athletics, or entertainment, including areas such as film and television. It allows individuals distinguished by their exceptional talent in their field to work in the U.S. for a specific employer or project. Applicants must demonstrate international recognition or significant accomplishments in their field.

Application Requirements and Evidence

The application process for the O-1 visa requires submitting substantial evidence of recognition or achievement. This may include awards, publications, reviews, letters of recommendation from professionals in the field, and other documentation. Candidates must also have a specific job offer in the U.S., and their work must be directly related to their extraordinary abilities.

Visa Duration and Dependent Family Members

The duration of the O-1 visa is typically up to three years, with the possibility of renewal for the period the applicant’s services in the U.S. are needed. With this visa, you can remain in the U.S. for as long as needed to complete your project. Your dependent family members (spouse and children under 21) may accompany you, but are not authorized to work in the U.S.

The O-1 visa is extremely important for individuals distinguished in areas such as the arts, sciences, and athletics. It offers unique opportunities for professional advancement in the U.S., while also recognizing and rewarding excellence across various fields. A reputable Greek citizenship lawyer can guide you through the process of acquiring this visa and provide the required evidence.

P-1 Visa: Athletes and Entertainment Groups

Greek and Cypriot citizens with skills in sports and entertainment can apply for a P-1 Visa to enter and stay in the United States. The P-1 visa is particularly intended for professional athletes or artists who wish to work in the U.S. for a specific event or performance. Depending on the events or activities you want to participate in the U.S. and the contributions to your profession, you can choose between P-1A for athletes and P-1B for artists and artist groups. Let’s have a look at how the two compare:

P-1A Visa: Internationally Recognized Athletes

The P-1A visa is for athletes and athletic teams who are internationally recognized for their exceptional skill and achievements in their field. To qualify, athletes must prove their reputation through awards, distinctions, or other internationally recognized accomplishments. Athletes must also have an offer from a U.S. employer or organization to participate in sports events or work as part of a sports team in the U.S.

P-1B Visa: Internationally Recognized Entertainment Groups

The P-1B visa is for artists and artist groups who have distinguished themselves in their field, whether musicians, dancers, actors, or other performers. To qualify, artists or groups must demonstrate their international recognition and achievements, such as awards, reviews, or significant participation in international events.

Duration of Stay and Family Members

The duration of the P-1 visa depends on the type of event or activity for which it is issued. Typically, the visa is granted for 1 to 5 years, with the possibility of renewal if the activity continues. If the work requires a longer period, the visa can be renewed in increments of 1 to 5 years for as long as needed for the specific event or activity. Families (spouses and minor children) of P-1 visa holders can travel with them to the U.S., but they do not have the right to work.

Q-1 Visa: Cultural Exchange Programs

Although lesser-known than most work visas in the U.S., the Q-1 visa is a great option for Greeks and Cypriots who wish to participate in cultural exchange programs. The purpose of this visa is to strengthen cultural, educational, and scientific relations between the U.S. and other countries through the exchange of knowledge and experiences. It allows participants to live and work temporarily in the U.S. for up to two years.

Program Focus and Eligibility

The Q-1visa is primarily meant for individuals who want to participate in cultural programs such as traditional dance groups, musical ensembles, theater troupes. It is also granted to those involved in educational or cultural activities that showcase and promote the culture and art of their home country. This visa provides the opportunity to work with organizations in the U.S. that promote cultural exchange without requiring extensive professional experience.

Sponsorship and Activities

The Q-1 visa is issued for specific exchange programs and requires sponsorship from a U.S. employer or organization that has received approval from the U.S. government to conduct cultural exchange programs. Visa holders may participate in events, presentations, and other activities that promote their country’s culture and contribute to understanding and cooperation between nations.

Duration of Stay and Family Members

The duration of the Q-1 visa is usually up to two years, with the possibility of renewal if the program continues or if there is another specialized need. Families of Q-1 visa holders (spouses and minor children) can travel with them to the U.S., although not authorized to work under this visa.

R-1 Visa: Religious Workers

The R-1 visa allows religious workers and employees of religious organizations to work temporarily in the U.S. It is meant for individuals employed by recognized religious institutions or organizations who wish to perform religious activities or services in the U.S. This visa is suitable for clergy, priests, monks, as well as other employees engaged in religious duties or administrative positions within religious organizations.

Eligibility Requirements

To be eligible to apply for the R-1 visa, applicants must meet the following requirements:

- The applicant’s work must involve religious service or activities directly related to their faith.

- The applicant must have at least two years of experience in their religious activity before applying.

- The U.S. organization employing them must be recognized and legally operating according to the rules of the religious community they belong.

Visa Duration and Family Benefits

The R-1 visa is typically issued for an initial period of 30 months, with the possibility of renewal for an additional 30 months, up to a total of 5 years. Family members may accompany the visa holder under the R-2 visa for spouses and children under 21 years old, although dependents are not authorized to work in the U.S.

Pathway to Permanent Residence

The R-1 visa offers a good opportunity for religious workers and employees of religious organizations to work in the U.S. for a limited time, and in some cases, it can serve as a pathway to permanent residence in the U.S. Greeks and Cypriots can liaise with an experienced Greek citizenship lawyer USA to ensure a smooth application process.

SB-1 Visa: Returning Resident

The SB-1 visa (Return Resident Visa) is a special immigrant visa that allows green card holders to return to the United States after being outside the country for an extended period. A green card holder may be considered to have lost permanent resident status if they remain outside the United States for more than a year without obtaining a Re-entry Permit. With the SB-1 visa, the holders regain their U.S. residency.

Eligibility for an SB-1 Visa

To qualify for an SB-1 visa, you must demonstrate that your extended absence from the U.S. was due to extraordinary circumstances and personal choice or negligence. You also must provide evidence of reasons such as serious illness, urgent family needs, or work obligations that require an extended absence. You must demonstrate that you intend to return to the U.S. permanently and maintain your permanent residency.

The SB-1 Visa Application Process

The SB-1 visa process involves an interview at a U.S. embassy or consulate and the submission of all required documents that demonstrate the reasons for being away from the U.S. and your continued intention to become a permanent U.S. resident. Since this process can be complicated and time-consuming, consulting a claim Greek citizenship lawyer can help to make sure you meet all the requirements.

The Risks of Immigrating to the USA Through a Sham Marriage

Some people have the misconception that a sham marriage with a U.S. citizen is an easy and quick way to immigrate to the U.S. In reality, however, the risks of such a marriage, if not entered into in good faith, are serious and significant. Unfortunately, many Greeks and Cypriots have fallen victim to this misconception. Here is what you need to know about the risk of a sham marriage as a pathway to immigrating to the United States.

Conditional Green Card and Proving Bona Fide Marriage

When someone applies for a green card after a recent marriage to a U.S. citizen (within the last two years), the green card they receive is conditional and temporary. It automatically expires two years from the date of issuance. However, the Greek or Cypriot spouse can apply for a permanent green card 90 days before the conditional card expires. This application must include evidence proving the genuine nature of the marital relationship. The immigration authorities may also call the spouses for an interview or conduct further investigations, such as asking neighbors if the couple lives together.

While marriage is a popularly used pathway for immigration, U.S. citizens willing to marry for money are generally unreliable individuals to trust with such a risky matter. The U.S. citizen may want to divorce in the future to remarry or extort the Greek or Cypriot spouse for more money. If pressured, they may confess the scheme to U.S. authorities.

Severe Legal Penalties for Marriage Fraud

U.S. law provides for imprisonment of up to five years and fines up to $250,000 for anyone knowingly entering into marriage with the intent to obtain immigration benefits fraudulently. Over 100 such cases are referred to prosecutors yearly in which U.S. citizens agree to testify against their Greek or Cypriot spouse in exchange for immunity from prosecution.

Permanent Inadmissibility

Even if the Greek or Cypriot spouse involved in a sham marriage is not criminally prosecuted, U.S. immigration law imposes a lifetime ban on entry for individuals who participated in fraudulent marriages with the intent to deceive the U.S. government.

If you want to immigrate to the U.S. through marriage, do it the right way. Working with a reliable Greek citizenship lawyer abroad is a great way of ensuring you do it right and for the right reasons.

W-9/W-8BEN Forms: Understanding Your Tax Status

In recent days, we have been receiving daily calls from Greeks and Cypriots born in the U.S. who have been asked by their foreign banks to complete the W-9/W-8BEN form. This happens because the banks have agreed with the U.S. tax authorities to identify individuals with indications of American citizenship, collect their information, and forward it to the U.S.

U.S. citizens are therefore required to complete the W-9 form and ensure they comply with all their tax obligations to the U.S. government. Our office will be happy to answer any questions you may have regarding this matter.

Alt Title: IRS Forms W-9 and W-8BEN

Alt Description: A photograph of the IRS W-9 and W-8BEN tax forms, relevant for Greek and Cypriot individuals who may need to declare their U.S. tax status to financial institutions.

Tax Obligations of U.S. Citizens

U.S. citizenship carries significant obligations for all American citizens. The most important obligations include filing U.S. yearly tax returns and reporting bank accounts held by U.S. citizens in foreign banks. The United States is probably the only developed country that exercises the right to tax citizens living outside its borders.

Who Must File a U.S. Tax Return?

U.S. tax law requires American citizens (and U.S. permanent residents with green cards) with income to file U.S. tax returns, even if the income is derived from activities outside the U.S. or the American citizen permanently resides abroad. However, there are a few exceptions for those with income below a minimum threshold. More information about filing a U.S. tax return can be found on the IRS website:

American citizens living in Greece and Cyprus with an annual family income above $14,600 (approximately €13,490) for singles or $29,200 (approximately €26,980) for married couples must file a U.S. tax return. The minimum thresholds are slightly higher for those over 65 and change slightly each year. To get an accurate figure, check the IRS website or consult a Greek citizenship lawyer to help you determine your requirements. Usually, income includes salary from paid employment, interest on bank deposits, capital gains from the sale of stocks or real estate, and more.

How to Avoid Double Taxation and Tax Liability?

The obligation to file a tax return in the U.S. does not necessarily mean there will be a tax liability to the U.S. government. The foreign earned income exclusion exempts up to $126,500 of earned income from foreign sources. Taxes paid to other countries can also be credited against or eliminate any U.S. tax liability. With Greece and the U.S. having signed a Double Taxation Avoidance Agreement, you can further reduce U.S. tax liability in several ways.

Deadlines and Enforcement of U.S. Tax Returns

The deadline for filing U.S. tax returns for individuals residing permanently in Greece and Cyprus is June 15 of the year following the tax year. Americans who have failed to file tax returns as required in the past must file late returns for the last three years. U.S. tax authorities have become strict on these matters; every time an American citizen applies for passport renewal, tax authorities are automatically notified to check if the citizen is up to date with tax obligations. So, do not be surprised if you receive a letter from the IRS a few months after renewing your U.S. passport. More information is available at the IRS website.

Foreign Bank Account Reporting (FBAR)

U.S. authorities have imposed an additional requirement on American citizens who hold foreign bank accounts with a total balance exceeding $10,000. Specifically, those who have or are co-owners or managers of accounts (bank, investment, etc.) in Greece or Cyprus with a cumulative balance exceeding $10,000 on any day of the calendar year must file a deposit report known as FBAR by April 15 of the following year (with an automatic extension until October 15). Failure to file an FBAR attracts severe consequences, including imprisonment for up to five years and fines of up to 50% of the total amount in the accounts. To get a clearer explanation of the FBAR, visit the IRS website or consult a reliable Greek citizenship attorney.

The FBAR Declaration: Reporting Foreign Bank Accounts

All U.S. citizens are required to report bank accounts they hold outside the U.S. (FBAR) with a combined balance exceeding $10,000 on any day to the U.S. authorities. With offshore bank accounts becoming one of the hottest issues for U.S. tax lawyers due to hefty penalties for failing to report, knowing how to navigate this issue is crucial.

How FBAR Enforcement and FATCA Were Enforced

FBAR started with Swiss banks, specifically UBS, which was accused of encouraging U.S. citizens to maintain secret accounts in Switzerland without paying taxes on the interest earned. After a lengthy investigation by U.S. tax authorities, the U.S. government and UBS reached an agreement, which turned over information on Americans with Swiss accounts and paid a $780 million fine. In the process, the U.S. government rewarded Bradley Birkenfeld, a former UBS employee who provided information to U.S. tax authorities a $104 million reward.

Today, the Foreign Account Tax Compliance Act, known as FATCA, requires banks operating outside the U.S. to identify any Americans holding accounts and report their information to U.S. authorities. The impact of FATCA has also reached Greece. Greek banks have already begun asking customers with ties to the U.S. whether they are subject to American tax laws. Greek nationality attorneys are also actively aiding citizens in navigating the obligations of this Act.

Penalties for Non-Compliance

Although FATCA is continuously becoming popular, many people have not filed their annual FBAR reports because of several reasons. However, the repercussions under the U.S. law are dire, including criminal penalties and imprisonment of up to five years, as well as civil penalties up to 50% of the maximum balance in each account for each year not reported. This means penalties can exceed the account balance if reports are missing for multiple years.

Amnesty Programs and Leniency

The U.S. government created an amnesty program to assist those who were not compliant in the past. The amnesty, which first started in 2009, was also made available in 2011 and finally in 2012. It shields participants from criminal or administrative penalties related to FBAR non-filing, provided that:

- The applicant entered the program before being targeted by U.S. authorities

- The applicant now makes truthful reports for prior years

- The applicant pays an administrative penalty equal to 27.5% of the highest balance of unreported foreign accounts. (In some cases, the penalty may be lower.) Those who filed honest tax returns and paid taxes but failed to report foreign accounts are exempt from this penalty and do not need to use the amnesty program.

Most U.S. citizens in Greece and Cyprus are still not compliant with their account reporting obligations, and a 27.5% penalty on their deposits seems excessive. After years of protests from thousands of outraged Americans abroad, the U.S. government announced it would show greater leniency toward Americans residing permanently overseas whose non-compliance was “non-willful.” Thus, Americans in this category can file late reports without risking the harsh penalties otherwise imposed by U.S. law.

General Advice and Conclusion: Your Journey to the U.S.

Immigrating to the United States from Greece or Cyprus requires a clear understanding of the legal landscape. While the path is rarely straightforward, hiring a Greek citizenship lawyer abroad can help you choose the right approach. To increase your chances of success, make sure you meet the requirements for the type of visa you want. For instance, you may need to acquire specialized qualifications that are in high demand in the U.S. job market. Similarly, you may want to avoid traveling under the Visa Waiver Program (VWP) or a tourist visa (B1/B2) if you want to find work or live permanently. Consulting an experienced Greek immigration lawyer who specializes in U.S. immigration law will help in assessing your eligibility and provide personalized guidance based on your unique circumstances.